To receive money with Zelle you must sign up with your bank. I am signed up with mine. The sender needs your e-mail address or mobile-phone number. Use

for me--my usual e-mail address.

for me--my usual e-mail address. Why I prefer Zelle for payments within the US.

Zelle is like an instant check without the paper or the need to mail it. It has no fees (See why and how below). What you pay is what I get, unlike PayPal. For example, if you pay $150 with PayPal it costs you $150 and I get $144 and PayPal takes $6 for the same transaction Zelle does for free.

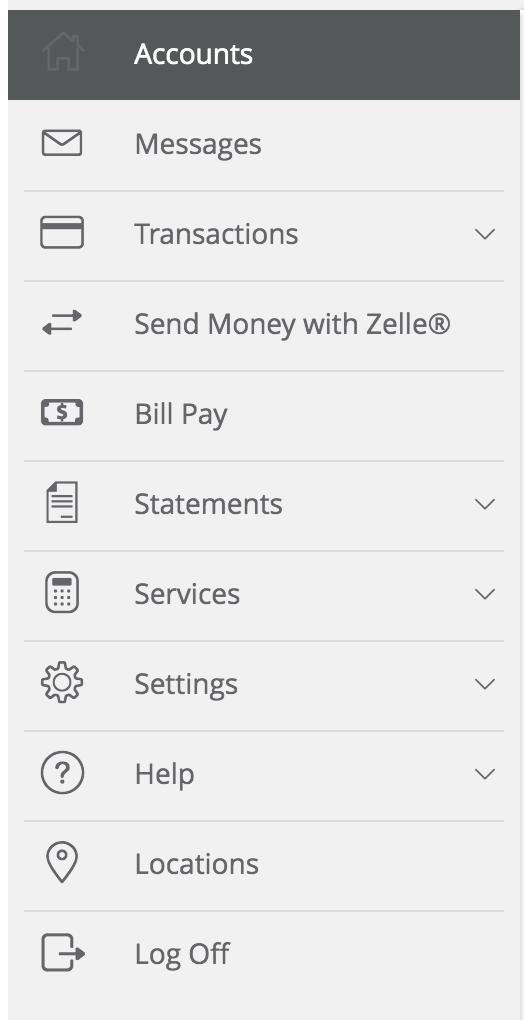

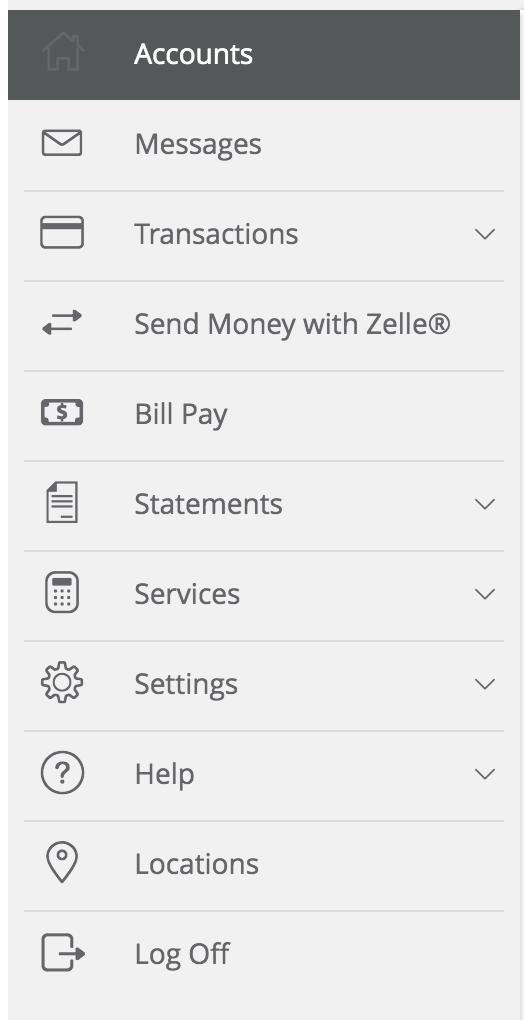

Zelle is a direct deposit system sponsored by your bank and used by most banks in the US to facilitate payments. It has no fees at all to you or to the recipient (unlike PayPal, which charges the recipient about 4%). It is easy to pay with Zelle from your on-line banking page. Mine has a prominent link right next to the "Transactions" link. Go to your on-line banking page and you will see the link. Just enter the e-mail of the recipient and send the money!

My on-line banking has this menu. See the link? (The third one down.)

To receive money with Zelle you must sign up with your bank. I am signed up with mine. The sender needs your e-mail address or mobile-phone number. Use  for me--my usual e-mail address.

for me--my usual e-mail address.

I wrote a customer March 24, 2020, "I got your Zelle payment. Great. Was it hard to do? What was the process?" He responded, "Super easy. Just a couple of verification steps and done."

You don't have to do this now; PayPal is fine. But, link your e-mail to your account once and you can get and send money easily thereafter with no fees.

No fees? How can they do it with no fees? Think about it. If you send a check your bank withdraws the same amount the recipient gets. That's no fees, but a hassel for the bank as some teller has to handle the check, scan it, and enter in the amount by hand. It is less cost to the bank to do it all electronically. And, less cost to you. You don't have to pay for the paper checks or for mailing the check. Also, I don't have to go to the bank and wait in line to deposit it. It's a win (the bank)-win (you)-win (me). Why give PayPal 4%?

Back to the sale page.